RESEARCH: The Easiest And Hardest Countries To Get A UK Expat Mortgage From

Release Date: 14/03/2024

UK Expat Mortgage, a specialist in mortgage solutions for British expats, has released its latest research shedding light on the easiest and hardest countries to secure a UK mortgage from as an expat.

The research has been conducted by expert expat mortgage advisers and is based on a comprehensive analysis of UK mortgage lender criteria for expats, looking specifically at the below criteria per country:

- Number of lending options on the market

- Affordability requirements

- Income status (lender flexibility and requirements)

- Deposit requirements and loan to value limitations

- Credit history / score requirements (both UK and overseas credit records)

- Application process and additional due diligence requirements

The research reveals intriguing insights into the accessibility of UK mortgages for British expats across the globe, and can help inform expats on their UK mortgage options before they relocate or decide to look into property investment in the UK.

Note: Some countries are excluded from this report where it is almost impossible to secure a UK mortgage as a resident of, due to a lack of willing mortgage lenders. For a full list of countries that are eligible for expat mortgage applications, see this list.

Important: Mortgages are approved on a case-by-case basis, and you should always seek financial advice when considering what mortgage product is right for you. Your home may be repossessed if you do not keep up repayments on your mortgage.

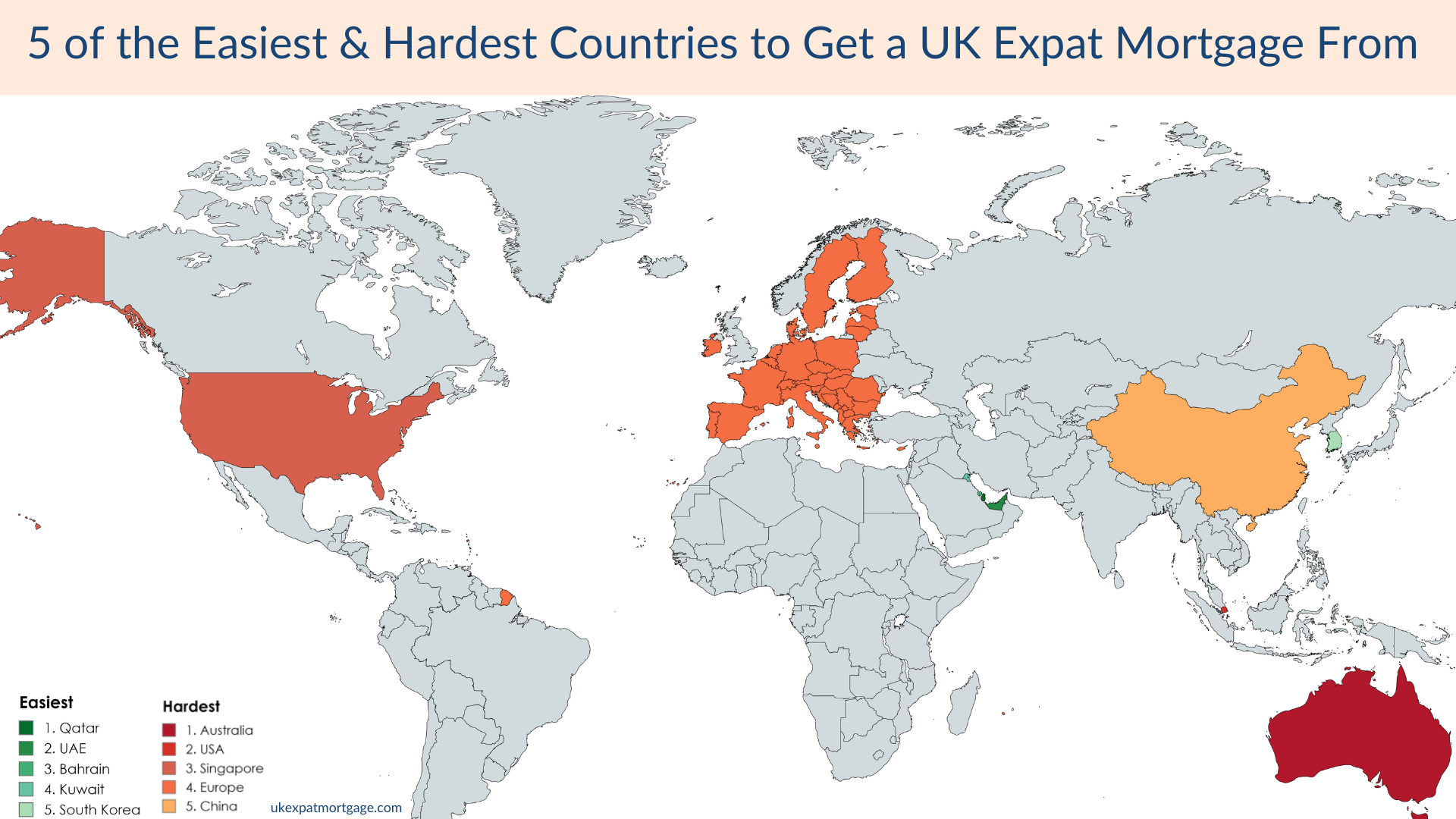

5 Of The Easiest Countries to Secure a UK Mortgage from as an expat:

1. Qatar: Qatar emerges as a surprisingly flexible and easy location to secure UK property finance from as an expat – and is arguably the easiest worldwide. With a thriving economy and robust financial sector, Qatar offers favourable conditions for expatriates seeking to invest in UK property.

2. UAE: The United Arab Emirates, known for its cosmopolitan cities and economic prosperity, expats can feel confident in their chances of securing a mortgage for a property back home. Despite stringent financial regulations in some areas, expatriates in the UAE find relatively smooth pathways to securing UK mortgages.

3. Bahrain: Nestled in the Persian Gulf, Bahrain boasts a burgeoning financial industry and a business-friendly environment. UK expats living in Bahrain benefit from a streamlined mortgage processes when buying investment or residential property in the UK, and generally favourable lending conditions.

4. Kuwait: With its stable economy and strong ties to the UK, Kuwait offers a surprisingly accessible route to obtaining a UK mortgage for expatriates. Borrowers will generally have multiple lenders to compare options from, and relaxed application criteria compared to other countries analysed.

5. South Korea: Rounding out the best countries is South Korea, a nation known for its technological advancements and economic prowess. Despite its distance from the UK, South Korea’s robust financial sector and favourable mortgage terms make it a surprisingly easy destination for expats residing in the country.

On the other side of the coin, some of the most difficult countries to secure a mortgage from as an expat may come as a shock to those unfamiliar with the international mortgage market.

5 Of The Hardest Countries for UK Expat Mortgage Applicants:

1. Australia: Despite its status as a major economic power and cultural hub, and its cultural and language similarities with the UK, Australia presents significant challenges for UK expat mortgage applicants – particularly the self-employed. Despite the allure of fantastic weather, English speaking residents and a Westernised culture, getting a mortgage for a property back in the UK will be very difficult.

2. United States: The land of opportunity, the United States surprisingly ranks among the toughest countries for UK mortgage applicants currently. Despite its vast economy and financial prowess, British expats in the States encounter limited options and stringent eligibility criteria when seeking UK mortgages for residential or buy to let investments from across the pond.

3. Singapore: Long hailed as a global financial hub and flourishing economy, Singapore has become increasingly challenging for the UK mortgage landscape. Obtaining a UK mortgage while living in Singapore has become unexpectedly challenging for expatriates – but not impossible.

4. European Countries: While Europe is among the most popular destination for expats, particularly for retirement, many European countries present unexpected hurdles for expats when looking for mortgage finance back in the UK. Many UK banks now blacklist most countries within the European Economic Area and exhibit reluctance to lend to UK expats living in Europe, significantly reducing options for those seeking mortgages from within the region.

5. China: As one of the world’s largest economies, China is among the top countries for British expats to relocate to for employment opportunities. But trying to get property finance back in the UK will be difficult once you’re out there – however, not impossible. You’ll like need to borrow less and adjust your property ambitions, or need to provide a bullet-proof mortgage application with the help of a broker.

Commenting on the findings, Louis Levine, a Senior Broker for UK Expat Mortgage, emphasised the significance of understanding global mortgage landscapes for UK residents:

“Our research underscores the importance of researching the UK property market for expats before moving to another country for work. If you’re looking to buy property in the UK with a mortgage while you work abroad – whether that’s an investment property or a new home for your family to reside in back home – make sure you’re informed about your finance options based on the country you’re headed to.

Some of these results will be a surprise to those unfamiliar with UK mortgage restrictions: unless you work in the industry, you’re unlikely to know about some of the challenges presented on these lists.”

Louis Levine, Senior Expat Mortgage Broker

** Disclaimer: The content provided on this website is based on research completed as of 14.03.2024. While we strive for accuracy, we acknowledge that information may change over time, and errors or omissions may occur. Therefore, we encourage users to independently verify any critical information and conduct their own investigations before making decisions based on the content presented here. This website does not constitute professional advice, and any reliance on the information provided is at your own risk. We recommend consulting relevant experts or seeking legal, financial, or other professional guidance as needed. By using this website, you agree to these terms and understand that the information provided may not always be up-to-date or accurate.

About UK Expat Mortgage:

UK Expat Mortgage specialises in mortgages for UK expatriates worldwide.

For media inquiries, please contact: contact@ukexpatmortgage.com

Website: https://www.ukexpatmortgage.com/